Online Money Tips -

How to Get a Free Credit Report

Online Money Tips

How to Get a Free Credit Report

/en/online-money-tips/how-to-avoid-tax-scams/content/

If you're planning to take out a loan—such as a home mortgage, car loan, or new credit card—you'll want to have a good overview of your most recent credit report. The more you know about your credit report, the better prepared you'll be when applying for a new loan.

A credit report is a record of how much money you've borrowed, where it was borrowed from, and how quickly you've been able to pay it back.

Banks and credit card companies refer to your credit report whenever you apply for a new loan. A history of late or defaulted payments can make it more difficult to secure a loan or low-interest rate, which is why it's so important to ensure your credit report is free from errors. Even a small mistake could make a big difference when applying for a loan.

It's equally important to check for any fraudulent activity—that is, any loans or credit cards that don't actually belong to you. This might be a sign of identity theft, which can seriously damage your credit.

A credit score is a number between 300 and 850 that's roughly determined by your credit report, and it's commonly used by banks and other financial institutions to quickly determine how much money they're willing to loan you.

It can also affect what type of interest rate you'll receive. Generally speaking, the higher your credit score, the lower your interest rate will be. While a low credit score doesn't necessarily mean you won't be offered a loan, it could translate into a higher interest rate, which makes the loan even more difficult to pay back.

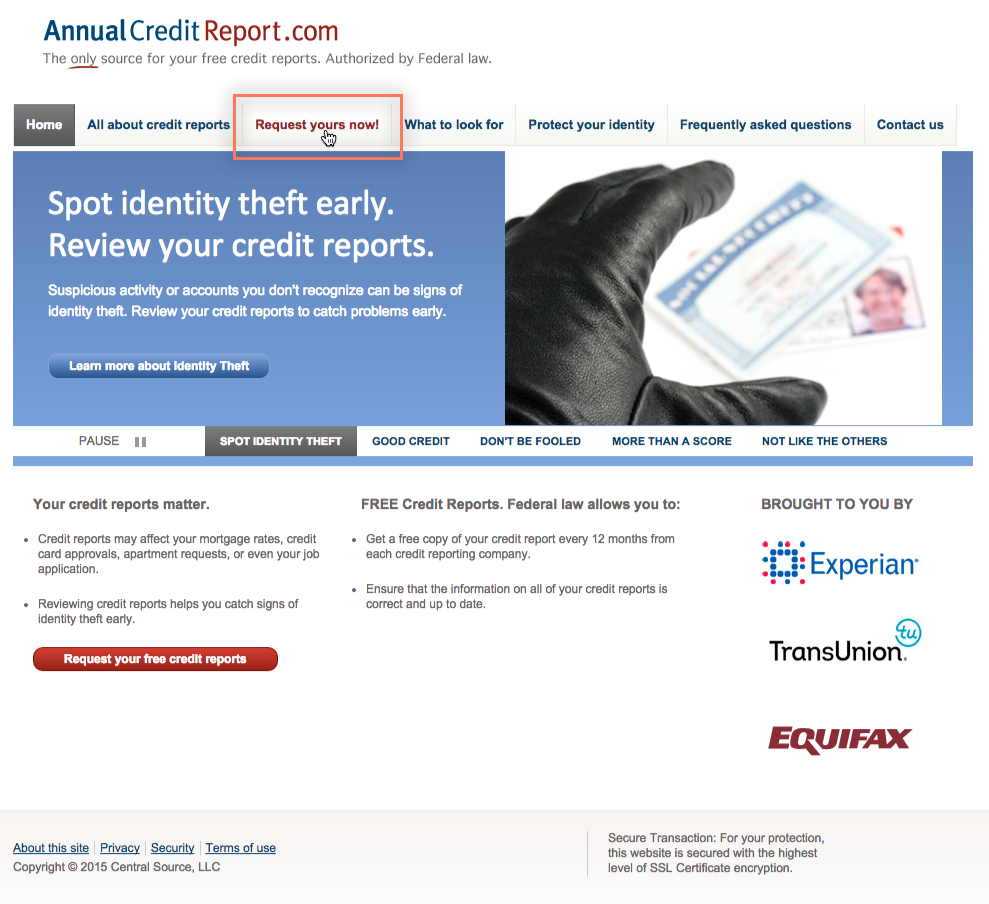

The best way to get your credit report is to visit www.annualcreditreport.com. Once you get to the site, locate and select Request yours now!

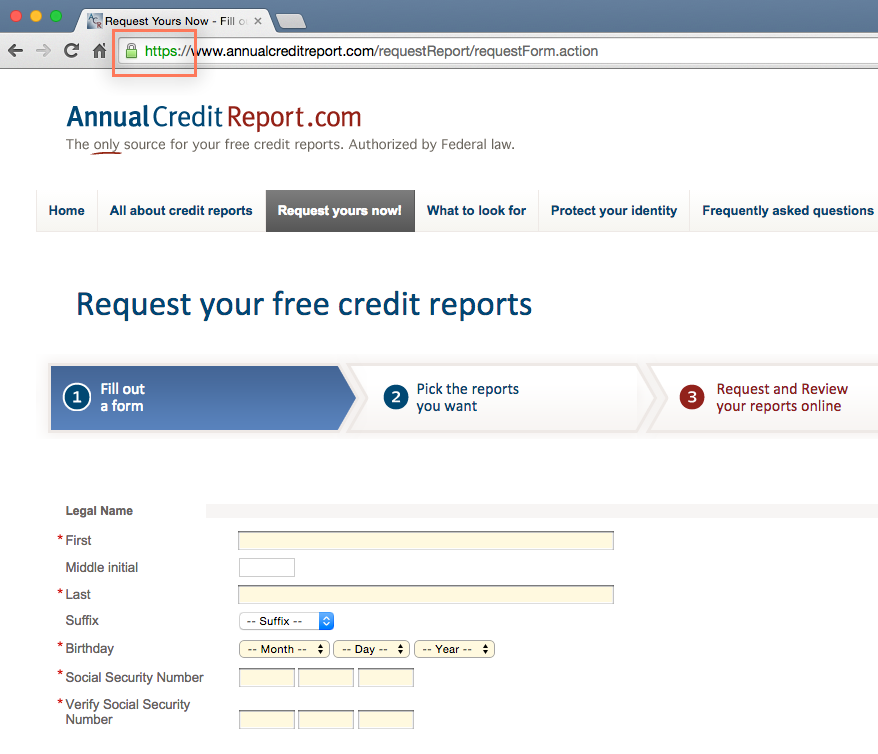

This includes your name and address, along with more personal information, like your birthdate and Social Security number (SSN).

While we would normally advise against providing your SSN to an online service, it's safe to do so in this case. Just make sure you see https:// in the leftmost corner of the address bar. And if you're not comfortable giving out your SSN online, you can always call (877) 322-8228.

At this point, you'll be able to view individual credit reports from each of the three main credit-reporting agencies: Experian, Equifax, and TransUnion. Note that you'll only be able to view these reports for free once per year, so you may want to consider only viewing the report from one agency at a time.

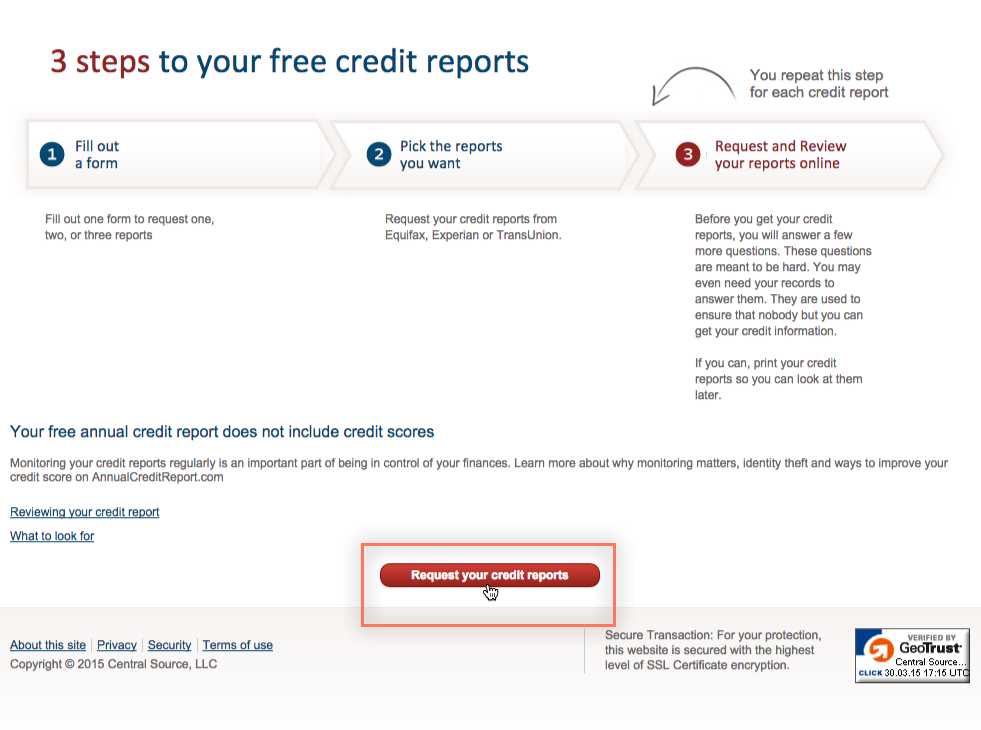

One thing your free credit report won't include is your credit score. While you can get an annual credit report for free, there's no easy way to see your credit score unless you're willing to pay for it.

Even websites like freecreditscore.com and freecreditreport.com will require you to sign up for a $20-per-month credit monitoring service before you can see your score. You can drop out of the service after a set time to avoid paying this fee, but in our opinion, this is a lot more trouble than it's actually worth.

If you really want to see your credit score, we recommend purchasing it from all three credit agencies at www.myfico.com or through their individual websites:

Note that all of these sites will also prompt you to enroll in a credit monitoring service, which carries a monthly subscription fee. This is an optional service, and it's probably not something you really need. For most people, the annual free credit report is more than enough information.

/en/online-money-tips/what-is-paypal/content/